Artificial Intelligence in Finance : Examples of Artificial Intelligence in Accounting

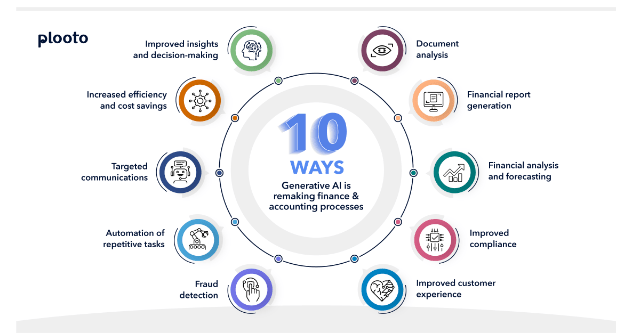

In today’s fast-paced financial world, artificial intelligence (AI) is transforming the way we handle finance and accounting. As technology advances, the integration of AI in finance and accounting has become more prevalent, offering innovative solutions that streamline processes, enhance accuracy, and drive efficiency. This blog will explore the various applications of AI in finance, with a particular focus on examples of artificial intelligence in accounting.

Introduction to AI in Finance

Artificial intelligence in finance refers to the use of intelligent algorithms and machine learning models to analyze financial data, automate tasks, and provide insights that support decision-making. This technology is revolutionizing the financial sector by enabling organizations to process vast amounts of data quickly and accurately. AI systems can identify patterns, predict market trends, and even detect fraudulent activities, making them invaluable tools for financial institutions.

The Role of Artificial Intelligence in Accounting and Finance

In the realm of accounting and finance, artificial intelligence (AI) is a game-changer, bringing about a significant transformation by automating repetitive tasks, reducing human error, and enhancing the overall efficiency of financial operations. By leveraging AI, accountants and financial professionals can redirect their efforts towards more strategic activities, such as financial planning and analysis. Let’s delve deeper into some common applications of artificial intelligence in accounting and finance:

Automated Data Entry

Manual data entry has long been a time-consuming and error-prone task in accounting. AI-powered systems are revolutionizing this aspect by automating the extraction and input of data from various financial documents, such as invoices, receipts, and bank statements. Here’s how it works:

- Optical Character Recognition (OCR): AI uses OCR technology to scan and read documents, converting the information into digital text. This process significantly reduces the time and effort required for manual data entry.

- Data Extraction: Advanced AI algorithms can accurately identify and extract relevant data fields from these documents, such as dates, amounts, vendor names, and invoice numbers.

- Data Integration: Once extracted, the data is automatically entered into the appropriate fields within the accounting software, ensuring that the records are updated in real-time.

The benefits of automated data entry include increased speed and accuracy, reduced labor costs, and minimized risk of human error. This automation allows accountants to focus on higher-value tasks, such as data analysis and strategic decision-making.

Predictive Analytics

Predictive analytics is another powerful application of AI in accounting and finance. By analyzing historical financial data, AI algorithms can forecast future trends and provide valuable insights that help organizations make informed decisions. Here’s a closer look at how predictive analytics works:

- Data Analysis: AI systems analyze large volumes of historical financial data to identify patterns and trends. This analysis includes various data points such as sales figures, market conditions, and economic indicators.

- Trend Forecasting: Based on the identified patterns, AI can predict future financial trends. For instance, it can forecast revenue growth, cash flow fluctuations, and potential financial risks.

- Scenario Planning: AI can also simulate different scenarios, helping organizations understand the potential impact of various decisions. This enables better strategic planning and resource allocation.

The insights provided by predictive analytics allow financial professionals to make proactive decisions, optimize budgeting and investment strategies, and mitigate risks. It transforms data into actionable intelligence, enhancing the overall decision-making process.

Fraud Detection

Fraud detection is a critical concern in the financial industry. AI systems play a crucial role in identifying and preventing fraudulent activities by detecting unusual patterns and anomalies in financial transactions. Here’s how AI enhances fraud detection:

- Anomaly Detection: AI algorithms continuously monitor financial transactions and compare them against historical data to identify deviations from normal patterns. For example, an unusually large transaction or a transaction from an unexpected location can trigger an alert.

- Pattern Recognition: AI systems are adept at recognizing complex patterns that may indicate fraudulent behavior. This includes identifying connections between seemingly unrelated transactions or detecting patterns consistent with known fraud schemes.

- Real-Time Monitoring: AI enables real-time monitoring of transactions, allowing for immediate detection and response to suspicious activities. This rapid response is crucial in preventing fraud and minimizing financial losses.

By incorporating AI into fraud detection processes, financial institutions can significantly enhance their ability to detect and prevent fraudulent activities. This ensures compliance with regulatory requirements and protects the organization’s financial integrity.

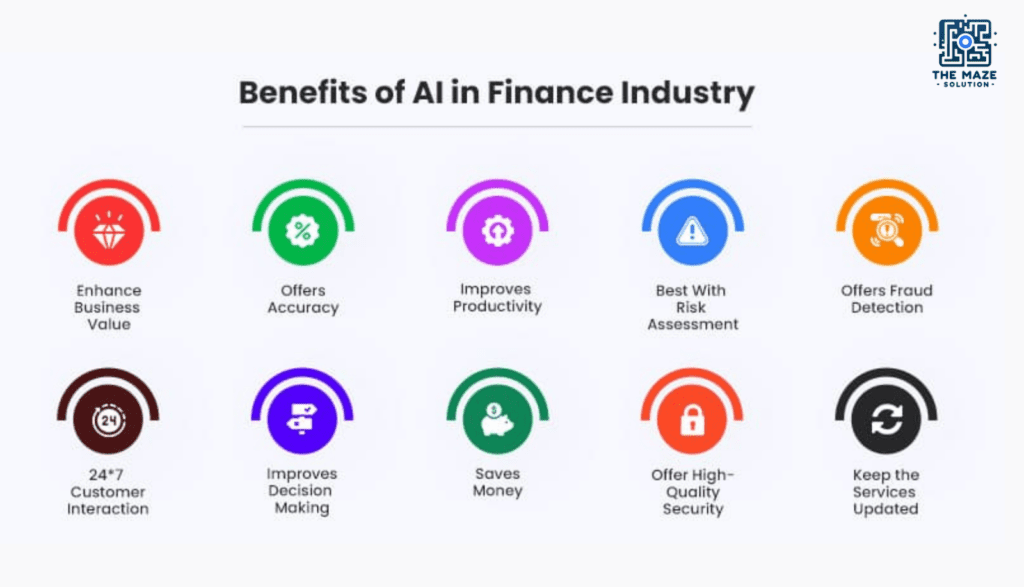

Enhanced Efficiency and Strategic Focus

Beyond these specific applications, the overall impact of AI in accounting and finance is profound. By automating routine tasks and providing deep insights through data analysis, AI frees up financial professionals to focus on more strategic and value-added activities. This shift allows for:

- Improved Financial Planning: Financial professionals can dedicate more time to developing comprehensive financial plans, optimizing resource allocation, and exploring growth opportunities.

- Strategic Analysis: With AI handling data entry and initial analysis, accountants can delve deeper into financial data, uncovering insights that drive strategic decisions and business growth.

- Innovation and Adaptability: The integration of AI encourages innovation within the finance department. Financial professionals can experiment with new tools and technologies, staying ahead of industry trends and adapting to changing market conditions.

Examples of Artificial Intelligence in Accounting

Artificial intelligence in accounting and finance is revolutionizing traditional practices by automating tasks, reducing errors, and providing advanced insights. Here are detailed explanations of how AI is transforming accounting processes, demonstrating the significant impact of artificial intelligence in finance.

One of the most labor-intensive tasks in accounting is the processing of invoices. AI-powered software can streamline this process by automatically reading and interpreting invoices, extracting relevant data, and inputting it into accounting systems. This automation reduces the time and effort required for manual data entry and significantly lowers the risk of errors.

Automating Invoice Processing

How It Works:

- Optical Character Recognition (OCR): AI utilizes OCR technology to scan and convert paper invoices into digital data.

- Data Extraction: The AI system identifies and extracts key information, such as invoice numbers, dates, amounts, and vendor details.

- Data Integration: Extracted data is automatically entered into the accounting software, ensuring real-time updates and accuracy.

By automating invoice processing, organizations can accelerate their accounts payable processes, improve cash flow management, and maintain accurate financial records.

Expense Management

Expense management is a critical aspect of accounting, and AI solutions can greatly enhance this process. AI can automatically categorize expenses, flag suspicious transactions, and generate real-time expense reports. This streamlines the management of corporate expenses, ensures compliance with company policies, and helps control costs effectively.

Benefits:

- Automated Categorization: AI systems can classify expenses into predefined categories, reducing the need for manual intervention.

- Fraud Detection: AI can identify unusual or unauthorized expenses, flagging them for further review.

- Real-Time Reporting: Organizations can access up-to-date expense reports, enabling better financial oversight and decision-making.

Using artificial intelligence in accounting and finance for expense management helps organizations maintain accurate financial records, optimize expense tracking, and enhance overall financial control.

Financial Forecasting

AI algorithms excel at analyzing historical financial data to predict future trends. By leveraging machine learning and predictive analytics, AI can forecast cash flow, identify potential financial risks, and recommend strategies for optimizing financial performance. This capability is crucial for financial planning and strategic decision-making.

How AI Enhances Financial Forecasting:

- Historical Data Analysis: AI analyzes past financial performance to identify trends and patterns.

- Trend Prediction: AI models predict future financial trends, such as revenue growth, expenses, and cash flow.

- Risk Assessment: AI identifies potential financial risks, allowing organizations to proactively manage and mitigate them.

By utilizing artificial intelligence in finance for forecasting, organizations can make more informed decisions, improve budget planning, and enhance overall financial stability.

Audit and Compliance

AI plays a significant role in enhancing the accuracy and efficiency of financial audits. AI systems can automate the review of financial statements and transactions, identifying discrepancies and ensuring compliance with accounting standards. This not only streamlines the audit process but also improves the reliability of financial reporting.

Key Advantages:

- Automated Reviews: AI can quickly and accurately review large volumes of financial data, identifying errors or inconsistencies.

- Compliance Assurance: AI ensures that financial records comply with regulatory standards and accounting principles.

- Audit Reports: AI generates detailed audit reports, highlighting key findings and recommendations.

The use of artificial intelligence in accounting and finance for audits and compliance helps organizations maintain transparent and accurate financial practices, reducing the risk of regulatory penalties.

Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants are increasingly being used in accounting to assist with customer inquiries, provide financial advice, and perform basic accounting tasks. These AI tools improve customer service and allow accountants to focus on more complex issues.

Applications:

- Customer Inquiries: AI chatbots can handle routine customer questions, such as account balances and transaction details.

- Financial Advice: Virtual assistants can provide personalized financial advice based on individual customer data.

- Basic Accounting Tasks: AI can automate tasks such as account reconciliation, invoice processing, and expense management.

By integrating artificial intelligence in accounting and finance, organizations can enhance customer satisfaction, improve operational efficiency, and allow accountants to concentrate on strategic activities.

The Impact of AI on Financial Decision-Making

Artificial intelligence in finance is not just about automation; it’s also about enhancing decision-making processes. By analyzing large datasets and providing real-time insights, AI empowers financial professionals to make more informed decisions. For example, AI in accounting and finance can help identify investment opportunities, optimize portfolio management, and assess the financial health of an organization.

Moreover, AI can provide personalized financial recommendations based on an individual’s financial goals, risk tolerance, and spending habits. This level of personalization was previously unattainable with traditional financial advisory services.

Challenges and Considerations in Implementing AI in Accounting and Finance

While the benefits of AI in accounting and finance are significant, there are also challenges to consider. Implementing AI systems requires substantial investment in technology and infrastructure. Organizations must also address data privacy and security concerns, as AI systems rely on vast amounts of sensitive financial data.

Additionally, there is a need for ongoing training and education to ensure that financial professionals can effectively use AI tools. The integration of AI also raises ethical considerations, such as the potential for bias in AI algorithms and the impact on employment in the financial sector.

Future Trends of AI in Accounting and Finance

The future of AI in finance and accounting looks promising, with continuous advancements expected in the coming years. Some emerging trends include:

- AI-Driven Financial Planning: AI will play a crucial role in developing more sophisticated financial planning tools, offering deeper insights and more accurate predictions.

- Enhanced Fraud Detection: As AI algorithms become more advanced, they will be better equipped to detect and prevent financial fraud, ensuring greater security and compliance.

- Integration with Blockchain: The combination of AI and blockchain technology can enhance transparency and security in financial transactions, creating a more robust financial ecosystem.

- Increased Adoption of AI by Small Businesses: As AI technology becomes more accessible and affordable, small and medium-sized enterprises (SMEs) will increasingly adopt AI solutions to streamline their financial operations.

Conclusion

management. By automating repetitive tasks, enhancing decision-making processes, and providing valuable insights, AI is helping organizations achieve greater efficiency and accuracy in their financial operations. Examples of artificial intelligence in accounting, such as automated invoice processing, expense management, and financial forecasting, demonstrate the practical applications of this technology.

As AI continues to evolve, it will undoubtedly play an even more significant role in the future of finance and accounting, driving innovation and creating new opportunities for growth. Embracing AI in accounting and finance is not just a trend; it is a strategic imperative for organizations looking to stay competitive in today’s dynamic financial environment.

Read our other Interesting Blogs:

“How to Turn Off Meta AI on Facebook?”This blog is really amazing if you want to get more knowledge about Artificial Intelligence: Click Here : How to Turn Off Meta AI on Facebook?

“10 Ways AI is Revolutionizing Daily Life” This blog is really amazing if you want to get more knowledge about Artificial Intelligence: Click Here : 10 Ways Artificial Intelligence is Revolutionizing Daily Life

“How AI Will Transform Everyday Tech? ” This blog gives you the knowledge that how Artificial Intelligence transforming us ,Click here to read : How Artificial Intelligence Will Transform Everyday Tech?

“The Future of Quantum Artificial Intelligence: Elon Musk’s Game-Changing Ideas ” This blog gives you the knowledge that how Artificial Intelligence transforming us ,Click here to read : The Future of Quantum Artificial Intelligence: Elon Musk’s Game-Changing Ideas